Great Facts For Choosing Credit Card Apps

Wiki Article

How Do I Check If My Credit Card Was Reported Stolen In The United States?

Follow these steps if you want to know if the credit card you've used was reported stolen or lost in America:- Contact your credit card issuer

Contact the copyright on the reverse of the credit card.

Tell the representative you'd like to inquire about the condition of your account and, if it has been reported as stolen or lost.

You will be asked to prove your identity through providing your personal information and credit card information.

Log in to your account

Login to your online account for credit cards or for banking.

Check for any notifications, alerts or messages concerning the status of your credit card.

Examine your most recent transactions for suspicious or illegal transactions.

Check Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Check the report for suspicious inquiry or credit account that could be a sign of suspicious activity.

Fraud Alerts and Security Freezes-

If you suspect identity theft or fraud you should place a freeze on fraud or alert on your credit file.

A fraud warning alerts lenders to additional measures they can take to verify identity before giving your credit. Meanwhile, a security freeze restricts access to your credit file.

Stay Vigilant and Report Suspicious Activity

Check your credit card statements frequently and immediately make a report of any suspicious or illegal transactions.

Report any suspected fraud or cases of identity theft to your local law enforcement agency as well as the Federal Trade Commission.

You can guard yourself against fraud with your credit card by contacting your card issuer, and then reviewing your account online. It is also important to monitor your credit report and be vigilant for any signs of fraudulent activity.

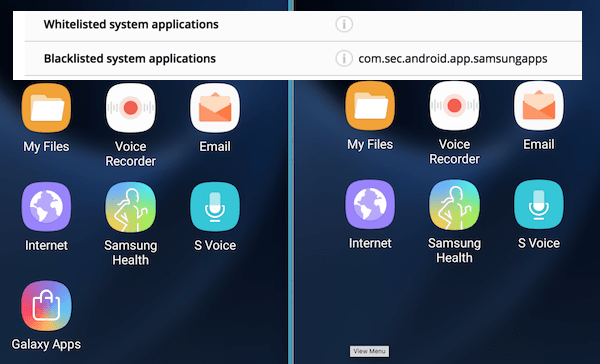

What Do I Mean By My Credit Card Being Blacklisted Mean?

If a credit card is listed on the blacklist, it generally refers to the card being identified as blocked or flagged by the issuer of the card or financial institution because of suspected suspicious activity, security concerns, or other reasons related to potential risks.Being on a blacklist implies that the card could be temporarily blocked from certain transactions or uses until the issue is resolved or verified by the cardholder. The reasons for a card being added to the blacklist may differ and could include:

Card blocked for security reasons If you suspect fraud, your credit card could be revoked if it is able to detect unusual or suspicious transactions.

Security Issues- If there are indications of possible breach for example, an unauthorised access, a data breach involving the card's information or a pattern of spending that is unusual or spending patterns, the card could be tagged for security reasons.

Issues with Identity Verification- Deficiencies in proving the identity of the cardholder during transactions, especially in situations where verification is needed, could lead to the card being temporarily blocked.

Card Lost or Stolen - If you notify the loss or theft of your card, an issuer will block access to the card until a replacement card has been issued.

Suspicious Activity Indicatesthe presence of any behavior or activity associated with your card is suspicious, such as several declined transactions, geographic abnormalities, or unusual spending patterns can cause a temporary blockage.

Cardholders could be denied using their credit cards for purchases or accessing credit if they are on a blacklist. This is until the card issuer can verify the legitimacy or address any concerns relating to fraud or security. The cardholder needs to contact the issuer right away to address the issue, confirm transactions and resolve any security issues.

How Do Cybersecurity Experts Be Aware Of Cyber Threats And Detect Them Such As Compromised Credit Card Information?

Cybersecurity experts employ a variety of strategies, tools and methods to detect and monitor cyber-related threats, including compromised credit card data. Some of the common methods and methods include: Threat Intelligence Gathering-

To keep up-to-date with the latest security threats and vulnerabilities, gather data from multiple sources, including forums as well as threat intelligence feeds, and monitoring of the dark web.

Network Monitoring and Intrusion Detection

Using specialized programs and software to track network activity and identify suspicious activities that could signal an unauthorised access or data breach.

Assessments of vulnerability and penetration testing

Regular tests can help you identify weak points in applications, networks, and systems. Penetration Testing involves simulating attacks to discover vulnerabilities and assess your organization's security posture.

Security Information and Event Management -

Implementing SIEMs that collect log data and analyse it across different sources (such a firewalls servers and applications) in order to detect security incidents and react to them quickly.

Behavioral analytics-

Conducting behavioral analyses to find patterns that are unique or distinct from the normal behavior of users in the network or system, which may indicate a potential breach.

Threat Hunting

Monitoring for indicators of threats or suspicious activities within an organization's network by analysing logs, traffic and system information to identify the possibility of threats that have evaded conventional security measures.

Endpoint Security Solutions-

Make use of endpoint security (such anti-malware programs as well as endpoint detection and response tools and others.) to safeguard endpoints and individual devices from malicious actions.

Data Security and encryption

Implementing encryption methods in order to safeguard sensitive data such as credit card numbers, while it is being stored and transmitted it will lower the likelihood that data breaches happen.

Incident response & Forensics

In the development and implementation of plan for responding to incidents in order to quickly react to security breaches. Conducting forensic analyses to identify and understand the scope, impact, and root cause of security breaches.

Cybersecurity professionals combine these approaches and a deep understanding of cyber threats and compliance regulations, as well as best practices, to proactively recognize and combat cyber-attacks. This includes those involving compromised card information. An active security strategy, continuous monitoring and intelligence on threats are vital to maintaining a robust cyber security. Have a look at the top rated savastan0 cvv for blog info.